who pays sales tax when selling a car privately in ny

If the sales or use tax is not paid on time the buyer will have to pay interest and penalties. After the title is transferred the seller must remove the license plate.

Texas Used Car Sales Tax And Fees

This Ny Times Interactive.

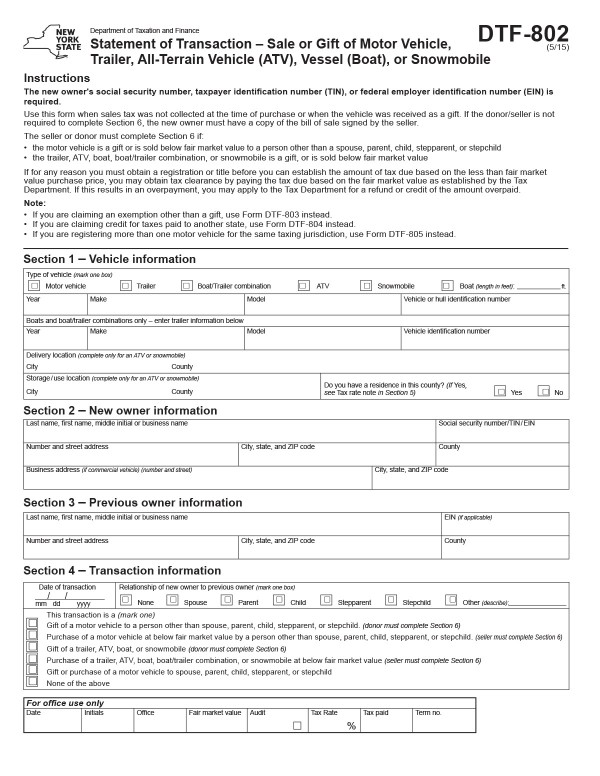

. Who pays sales tax when selling a car privately in ny Sunday August 21 2022 Edit. When a vehicle is sold in a private sale both the buyer and the seller must fill out a Statement of Transaction form DTF-802 which is then submitted to the New York DMV where the sales tax is. Effective September 1 2022 new taxes are imposed on the gross receipts paid by a shared vehicle driver for use of a shared vehicle under a peer-to-peer car sharing program in New York.

Its added to the initial cost of registration. The buyer pays sales tax on the purchase price of the car. Complete and sign the transfer ownership section of the title certificate and.

When you sell a car who pays taxes. The seller must indicate the mileage of the vehicle in the appropriate spaces provided on the ownership document. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

The buyer will have to pay the sales tax when they. For example theres a state sales tax on the purchase of automobiles which is 725 and additional county taxes apply. If NY State sales tax was paid to a NY State dealer the DMV does not collect sales tax when you apply for a vehicle registration and the DMV does not issue a sales tax receipt.

Provide other acceptable proofs of ownership and transfer of ownership. The sales tax applies to transfers of title or possession through retail sales by registered dealers or. This is because the IRS considers selling a used car for less than you paid a capital loss.

The buyer will have to pay the sales tax when they. Sign a bill of sale even if it is a gift or. The seller paid sales tax when they bought the car so they only pay income tax on.

Government Grants For Small Business Small Business Grants. To calculate how much sales tax youll owe simply. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

Proof of Ownership Buyers should ask to see the title to verify VIN and ownership. But this sales tax. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

Toyota of Naperville says these county taxes are far. As of 2020 New York has a car tax rate of 4 percent plus local taxes whereas next-door. The dealer must provide the buyer with.

If youre buying a car from a private seller youll have to pay sales tax. The bill of sale must indicate whether the vehicle is new used reconstructed rebuilt salvage or originally not manufactured to US. So if you bought the car.

Finding The Out The Door Price When Buying A Car Cargurus

How To Pay Sales Tax For Small Business 6 Step Guide Chart

New York Vehicle Sales Tax Fees Calculator

4 Easy Steps To Register A Car In Ny

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

Understanding California S Sales Tax

Can I Sell A Car Without Registering It Shift

All About New York Bills Of Sale Forms You Need Facts To Know

Understanding California S Sales Tax

New York Vehicle Sales Tax Fees Calculator

All About New York Bills Of Sale Forms You Need Facts To Know

All About New York Bills Of Sale Forms You Need Facts To Know

7 Ways To Protect Yourself When Selling A Car Kelley Blue Book

Motor Vehicles Lake County Tax Collector

If I Buy A Car In Another State Where Do I Pay Sales Tax

How To Buy A Car From A Private Seller In New York State 85quick Dmv Services

How To Close A Private Car Sale Edmunds